cayman islands tax treaty

If the treaty does not cover a particular kind of income or if there is no treaty between your country and the United States. Cayman signed its first Mutual Legal Assistance Treaty with the USA in the 1980s and has tax information exchange agreements with 36 jurisdictions.

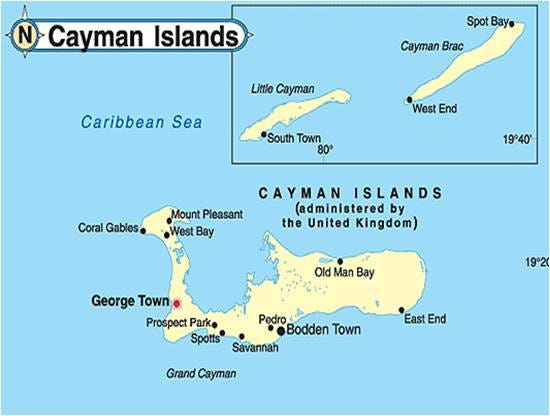

An Overview Of The Cayman Islands By Ben Hinson Countries Around The World

Automatic data exchange as part of the European Union Savings.

. Since then the number of TIEAs that Cayman has in force has proliferated. Cayman Islands Foreign Bank Account Reporting The FBAR FinCen Form 114. China - Cayman Islands Tax Treaty AGREEMENT BETWEEN THE GOVERNMENT OF THE CAYMAN ISLANDS AND THE GOVERNMENT OF THE PEOPLES REPUBLIC OF CHINA FOR THE EXCHANGE OF INFORMATION RELATING TO TAXES The Government of the Cayman Islands and the Government of the Peoples Republic of China the Contracting Parties.

Our team of Cayman Islands incorporation agents presents some of the main issues included in the treaty. 1 April 2011 for Corporation Tax 6 April 2011 for Income and Capital. Not having any taxes other than customs duties and stamp duty the Cayman Islands did not until recently enter into any double tax treaties with other countries.

AND THE GOVERNMENT OF CANADA FOR THE EXCHANGE OF INFORMATION ON TAX MATTERS. Income taxes on certain items of income they receive from sources within the United States. It has however entered into limited tax treaties with the UK and New Zealand and signed a comprehensive tax treaty with Japan in 2010 see below in addition to several tax information.

Its effective in the UK and the Cayman Islands from. Under these treaties residents not necessarily citizens of foreign countries may be eligible to be taxed at a reduced rate or exempt from US. THE GOVERNMENT OF THE CAYMAN ISLANDS UNDER ENTRUSTMENT FROM THE GOVERNMENT OF THE UNITED KINGDOM OF GREAT BRITAIN AND NORTHERN IRELAND.

These reduced rates and exemptions vary among countries and specific items of income. The Cayman Islands and the United States signed their Agreement to Improve International Tax Compliance and to Implement the Foreign Account Tax Compliance Act based on the Model 1 IGA in 2013. This is entirely untrue.

A tax treaty is also referred to as a tax convention or double tax agreement DTA. While Cayman does have a small tax-treaty network comprising 10 members the absence of direct taxes makes it very unlikely that a double-taxation dispute will. Canada - Cayman Islands Tax Treaty.

Cayman Islands Highlights 2022. At the time of signing of this Agreement between the Government of Canada and the Government of the Cayman Islands under Entrustment from the Government of the United Kingdom of Great Britain and Northern Ireland for the Exchange of Information on Tax Matters the undersigned have agreed upon the following provisions which shall be an integral part of this Agreement. Duty charged at varying rates depending on the goods is levied on most goods imported into the islands.

Our advice in this case is to. A common misunderstanding of US citizens and green card holders living in the Cayman Islands is that they do not need to file US income tax returns if their earned income is less than the foreign earned income and housing exclusions discussed above. Tax treaties are formal bilateral agreements between two jurisdictions.

The DTA applies to individuals natural or legal who are residents of one or both jurisdictions. They have no income tax no property taxes no capital gains taxes no payroll taxes and. It should also be obvious to the editor of The Economist and in fairness he draws reference to the offending EU based double treaty tax jurisdictions that the zero tax jurisdictions notably the Cayman Islands are in no way involved in the mechanics of profit shifting by way of the application of the excessive transfer pricing practices of these US corporates.

Here Are Some Of The Most Sought After Tax Havens In The World Chile Last reviewed 11 December 2021. There also is a tonnage fee for vessels. Cayman does not have legal mechanisms or treaties such as double taxation agreements in place with other countries to legally transfer tax bases from one country to another in order to aggressively reduce taxes.

The Double Taxation Arrangement entered into force on 20 December 2010. The Cayman Islands landmark 12th tax information exchange agreement was signed with New Zealand in August 2009 moving the jurisdiction onto the whitelist of countries that have substantially implemented the OECDs internationally agreed tax standard. Cayman islands tax treaty Saturday February 19 2022 Chad Last reviewed 03 August 2021 Resident.

In addition to having no corporate tax the Cayman Islands impose no direct taxes whatsoever on residents. The agreement between the government of the united states of america and the government of the united kingdom of great britain and northern ireland including the government of the cayman islands for the exchange of information relating to taxes done on november 27 2001 at washington the 2001 agreement shall terminate on the date of entry. Does not have a tax treaty with the Cayman Islands and as a result there are no benefits for Cayman Islands Expat Tax from this perspective.

Most income tax treaties contain what is known as a saving clause which prevents a citizen or resident of the United States from using the provisions of a tax treaty in order to avoid taxation of US. US- Cayman Islands Tax Treaty And Cayman Islands Expat Tax The US. To accommodate the non-direct tax system of the Cayman Islands the IGA is a model 1B non-reciprocal IGA.

Cayman Islands Individual - Foreign tax relief and tax treaties Last reviewed - 08 December 2021 Foreign tax relief Since no income taxes are imposed on individuals in the Cayman Islands foreign tax relief is not relevant in the context of. Tax treaties Details of tax treaties in force between the UK and Cayman Islands provided by HMRC. Australia has tax treaties with more than 40 jurisdictions.

US citizens and green card holders living in Cayman must file a tax. The Multilateral Convention on Mutual Administrative Assistance in Tax Matters which allows tax information exchange with more than 140 countries. The Cayman Islands has not concluded any tax treaties.

It is not the. They prevent double taxation and fiscal evasion and foster cooperation between Australia and other international tax authorities. WHEREAS the Government of the.

Department for International Tax Cooperation.

Cayman Islands Offshore Companies And Services Offshorecircle Com

How To Move Your Business To Cayman And Pay No Tax Escape Artist

How To Open An Offshore Bank Account In The Cayman Islands

What Makes Cayman Islands So Popular For Hedge Funds International Finance

Here Are Some Of The Most Sought After Tax Havens In The World

An Overview Of The Cayman Islands By Ben Hinson Countries Around The World

/CIA_map_of_the_Caribbean-822e94431d4647ba9ca350ebf28eb23b.png)

Top 10 Offshore Tax Havens In The Caribbean

Cayman Islands And Income Taxes As A Canadian R Personalfinancecanada

Move Your Canadian Business To The Cayman Islands

A Guide To Cayman Island S Taxation System Zegal

Cayman Islands And Cryptocurrency Blockchain And Cryptocurrency Regulations

Why Coronavirus In Cayman Risks Brazilian Offshore Assets By Matthew Feargrieve Medium

Are The Cayman Islands Tax Neutral Oasis Land Development Ltd

Letter From Brussels Pressure Builds On Tax Havens Analysis Ipe

Important Changes For Cayman Islands Investment Funds Aml Regulations Vistra

Cayman Islands Government And Society Britannica

Registration Of Company In Cayman Islands Offshore In Cayman Islands Company Registration For Business Purposes Law Trust International

Lowtax Global Tax Business Portal Cayman Islands Business Taxation And Offshore Information

Cayman Islands And The Eu List Of Non Cooperative Tax Jurisdictions