am i taxed on stock dividends

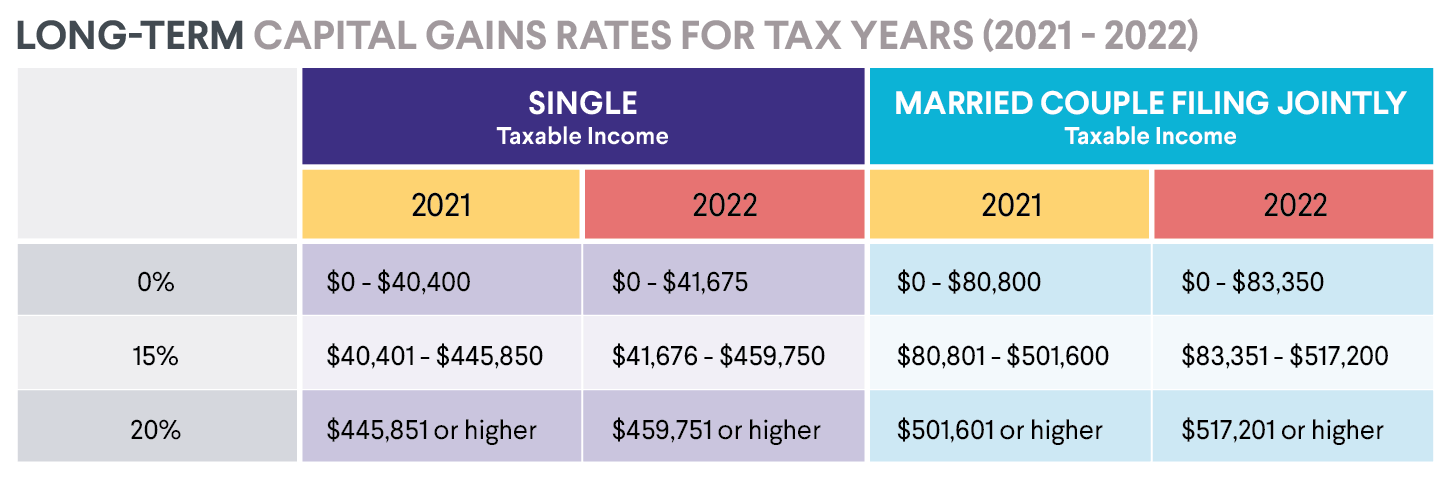

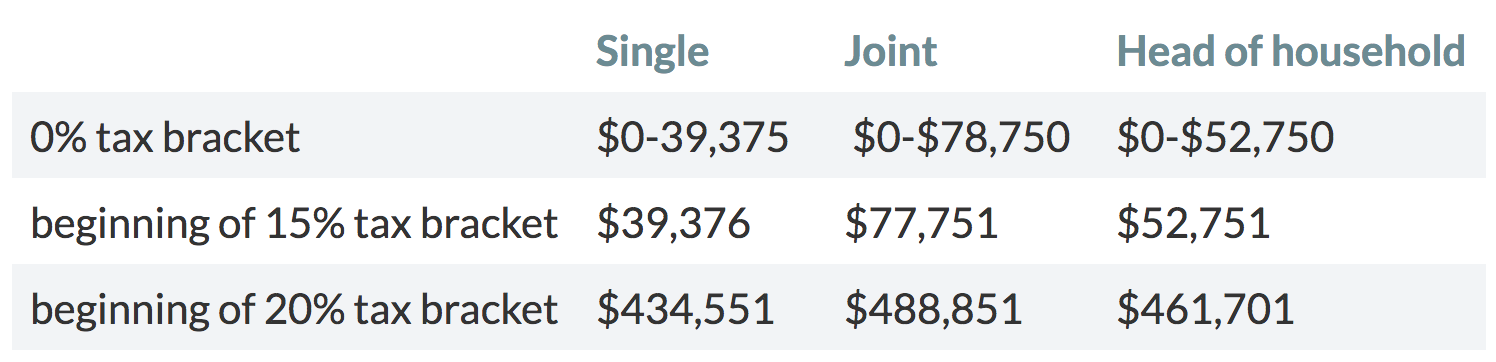

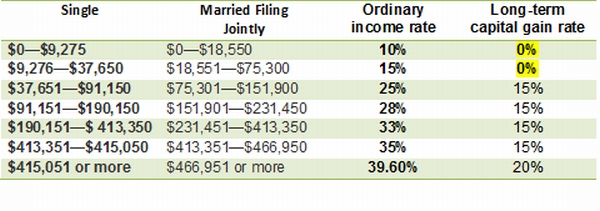

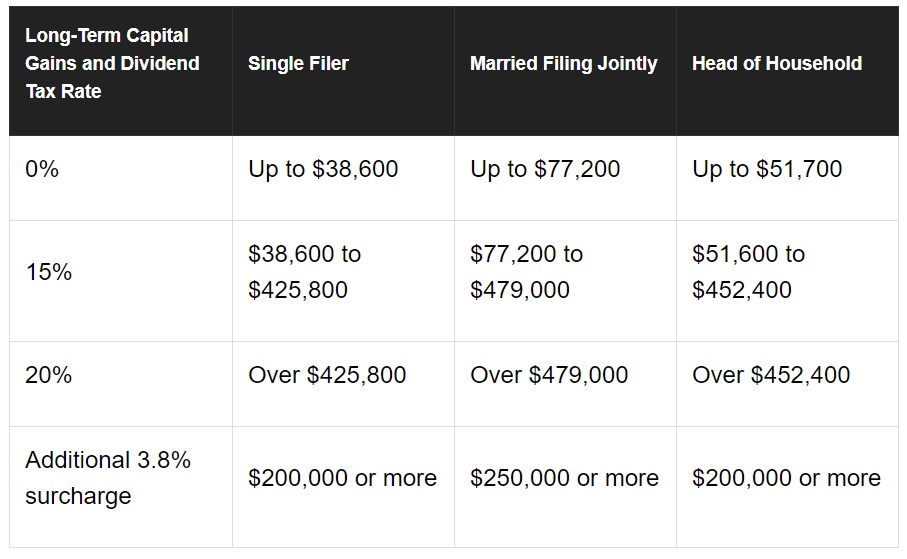

The tax rate on qualified dividends is 0 15 or 20 depending on your taxable income and filing status. You should consult your own tax legal and accounting advisors before engaging in any financial transaction.

Are Lower Tax Preferred Stock Dividends Really A Better Deal Seeking Alpha

If you are in the 35 tax bracket a qualified dividend is going to be taxed at 15.

. Ordinary dividends are taxed as ordinary income. How Are Dividends Taxed. Well lucky you but youll have to pay 20 percent on those qualified dividends and long-term capital gains source.

Generally any dividend that is paid out from a common or preferred stock is an ordinary dividend unless otherwise stated. However there are. 80801 for married filing jointly or qualifying widower filing status.

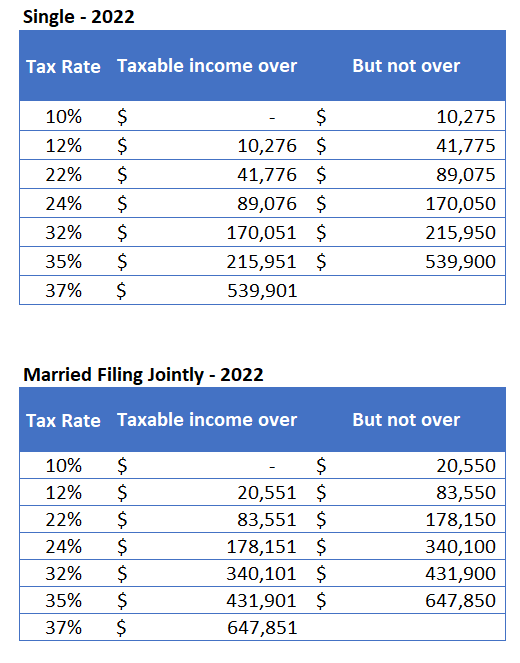

The tax rate on nonqualified dividends. This presents some special considerations at tax time regarding filing rules and various applicable taxes. The tax on dividends depends on how they are classified.

Sometimes theyre taxed at ordinary tax rates but qualified dividends are taxed at lower capital gains rates. Morgan Wealth Management is a business of JPMorgan Chase Co. For 2021 qualified dividends may be taxed at 0 if your taxable income falls below.

This information is included on the individuals Form 1040. For retirement accounts stock dividends are not taxed. Qualified dividends are taxed at a lower rate than ordinary income at the capital gains tax rate.

Theyre a share of corporate profits that are paid out to investors. Qualified dividends are dividends that meet the requirements to be taxed as capital gains. In a bracket above 35 percent.

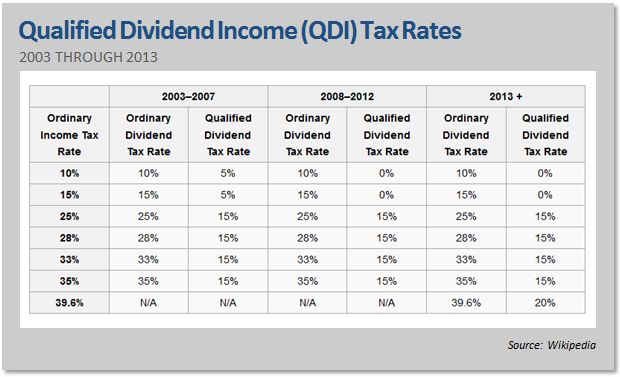

For stock dividends it depends on the type of account. These dividends are federally taxable at the capital gains rate which depends on the investors modified adjusted gross income AGI and taxable income the current rates are 0 15 188 and 238. Lastly investors that were in the four middle brackets 25 28 33 or 35 paid a 15 tax rate for their income derived from qualified dividends.

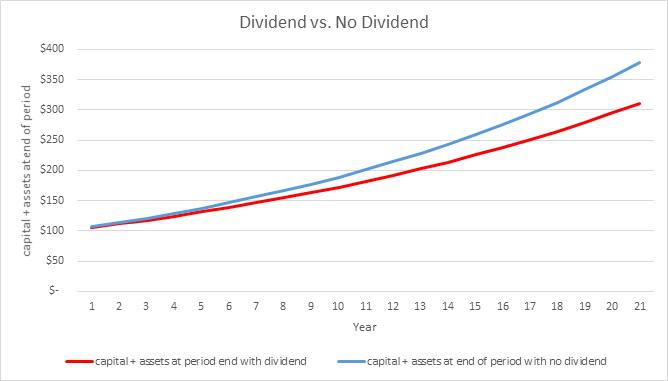

Dividends that dont meet the qualified dividend conditions are generally taxed at ordinary income rates. The qualified dividend tax rate. Preferred stock dividends can generate tremendous growth in a tax-sheltered account especially if they are reinvested regularly.

Qualified dividends are taxed at. 40001 for those filing single or married filing separately 54101 for head of household filers or. Even if you reinvest all of your dividends directly back into the same company or fund that paid you the dividends you will pay taxes as they technically still passed through your hands.

The tax on dividends depends on how they are classified. It must pay 30 tax on that profit which is 150 per share leaving 350 per share able to be either retained by the business or paid out as dividends to shareholders. If your ordinary income was 85000 the 401 k withdrawal would bring you to 94000.

Legal and accounting advice. Under current law qualified dividends are taxed at a 20 15 or 0 rate depending on your tax. The taxpayers in the top bracket of 396 used to pay a 20 tax rate on qualified dividend income.

Usually the marginal tax rate is. Learn more about it. ABC Pty Ltd decides to retain 50 of the profits within the business and to pay shareholders the remaining 175 as a fully franked dividend.

Yes the IRS considers dividends to be income so you usually need to pay taxes on them. For retirement accounts stock dividends are not taxed. Ordinary non-qualified dividends are taxed at your normal tax rate along with your other income.

But if it is an ordinary dividend it will be treated as ordinary income which means the tax hit is. To lower your tax rate on income consider owning investments that pay qualified dividends. If youre in the 25 to 35 percent tax bracket your qualified dividends will be taxed at 15 percent.

Dividends are reported to individuals and the IRS on Form 1099-DIV. If you have qualified dividends and the appropriate paperwork however then your dividend tax is one of three figures 20 15 or nothing at. To summarize heres how dividends are taxed provided that the underlying dividend stocks are held in a taxable account.

Qualified dividends are taxed as capital gains while non-qualified dividends are taxed at the marginal tax rate. In 2018 that puts you in the 24 tax bracket which means that 9000 becomes 6840 after taxes. You wont pay taxes on dividend income as it comes in.

As for how dividends are taxed qualified dividends which must meet several conditions are generally taxed at preferential long-term capital gains rates that are generally lower than ordinary income tax rates. Giphy where it is domiciled matters. The dividend allowance is in addition to your personal allowance which is the amount you can earn each tax year before you have to start paying tax.

Qualified dividend taxes are usually calculated using the capital gains tax rates. Instead youll pay only when you withdraw money from the account. Qualified dividends are a type of investment income thats earned from stocks and mutual funds that contain stocks.

Tax Implications Of A Dividend H R Block

Do You Pay Taxes On Investments White Coat Investor

Guide To Taxes On Dividends Intelligent Income By Simply Safe Dividends

How To Pay No Tax On Your Dividend Income Retire By 40

How Dividend Reinvestments Are Taxed Intelligent Income By Simply Safe Dividends

Selling Shares Beats Collecting Dividends Physician On Fire

Taxes What Realty Income Corp Shareholders Need To Know The Motley Fool

Capital Gains Tax What Is It When Do You Pay It

Our Retirement Investment Drawdown Strategy The Retirement Manifesto Investing For Retirement Investing Finances Money

Taxation Of Dividend Income And Capital Gains

How To Reduce Capital Gains Tax On Stocks

How Are Dividends Taxed Overview 2021 Tax Rates Examples

The Tax Inefficiencies Of Dividends Seeking Alpha

What You Need To Know About Capital Gains Tax

/shutterstock_342649796-5bfc3d8846e0fb00511e30c8.jpg)